Remember when you could track who owned what simply by looking at bank statements and stock certificates? Well, welcome to 2025, where Bitcoin has quietly orchestrated the most dramatic shift in wealth ownership patterns we’ve witnessed since the rise of mutual funds – except this time, the biggest players aren’t your traditional Wall Street firms, but tech companies, sovereign nations, and a mysterious cast of “whales” controlling digital fortunes worth hundreds of billions.

Let me tell you what I’ve discovered about who actually owns Bitcoin today. Spoiler alert: it’s not what you might expect.

The Numbers Don’t Lie (Even If Some Crypto Bros Do)

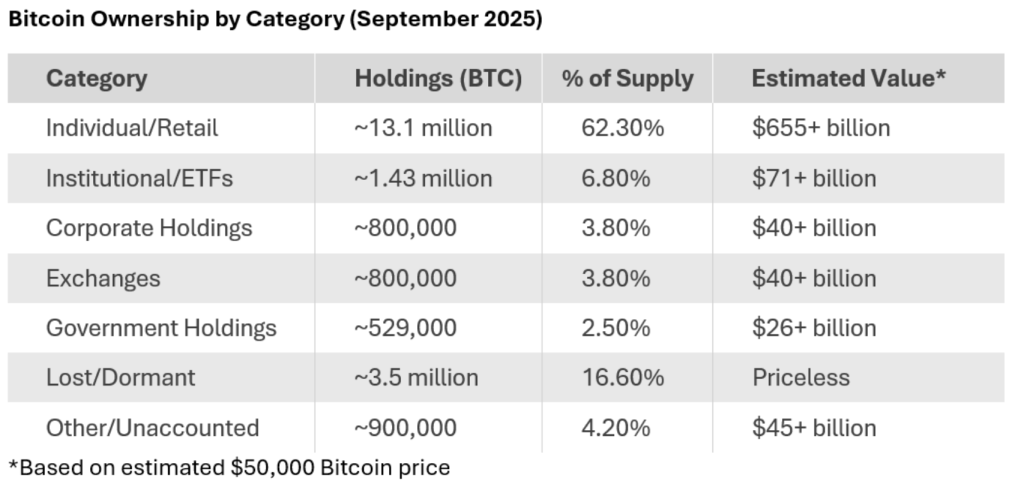

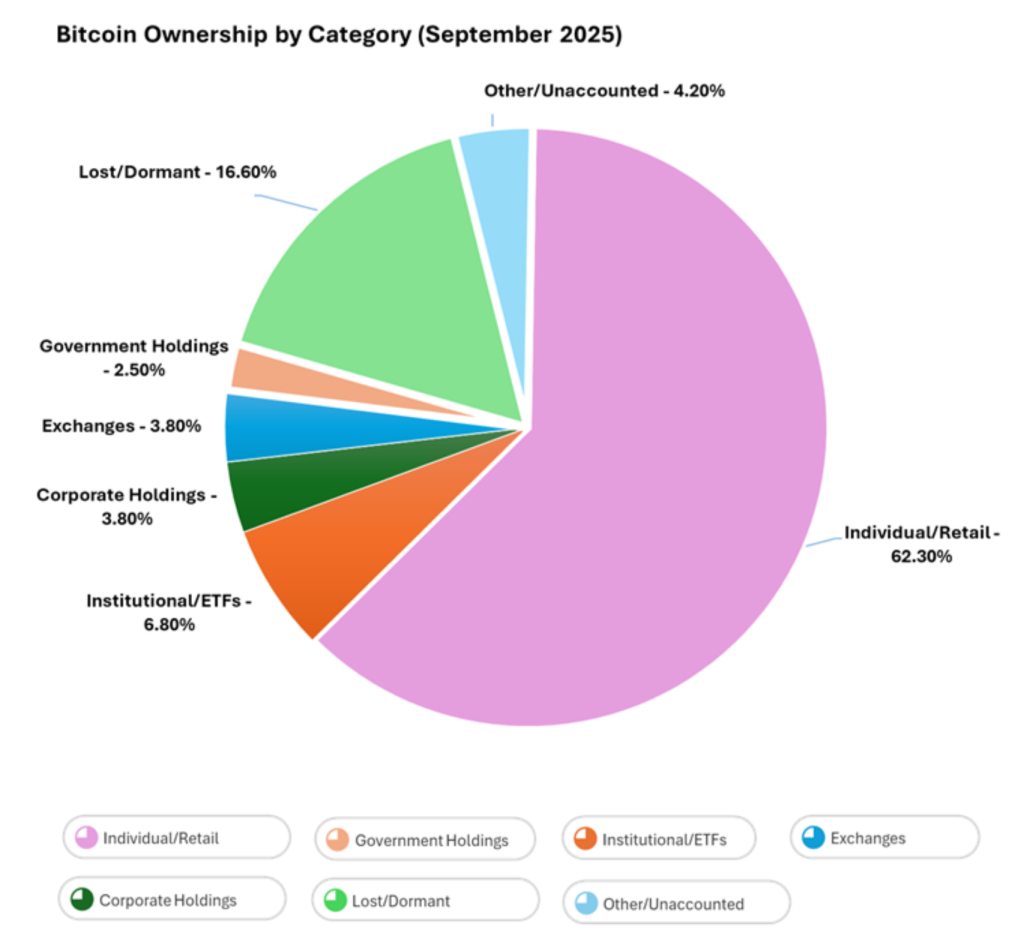

As of September 1st, 2025, we’re looking at a fascinating snapshot of digital wealth distribution. With 19.9 million Bitcoin already mined out of the total 21 million that will ever exist, we’re at 94.8% completion of this grand experiment. Think of it like a giant jigsaw puzzle that’s almost finished – and everyone’s fighting over the remaining pieces.

Here’s what really caught my attention: while individual investors still hold the majority at nearly 66%, the concentration among large holders is staggering. About 40% of all Bitcoin sits in wallets containing over 1,000 BTC each. To put that in perspective, that’s like saying 2% of homeowners own 40% of all the houses – except these “houses” can be worth tens of millions of dollars each.

The Institutional Invasion: Wall Street Discovers Bitcoin

Remember when your biggest worry about institutional money was whether your pension fund was buying too many risky stocks? Well, now that same pension money might be buying Bitcoin – and doing it through something called an “ETF,” which is basically a way for traditional investors to buy Bitcoin without actually having to figure out those complicated digital wallets.

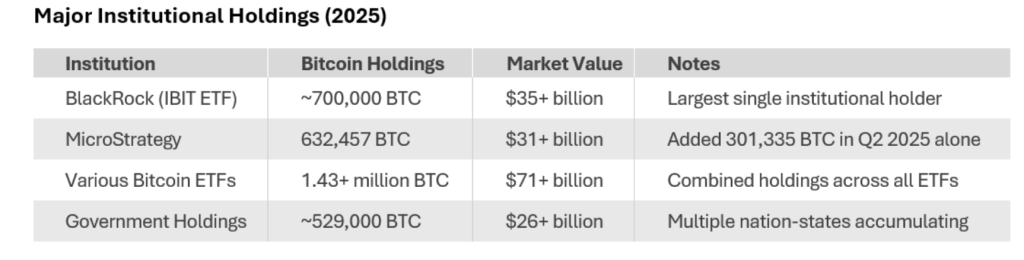

BlackRock – yes, the same BlackRock that probably manages part of your retirement fund – now holds nearly 700,000 Bitcoin. That’s more Bitcoin than most small countries’ entire GDP in traditional money terms.

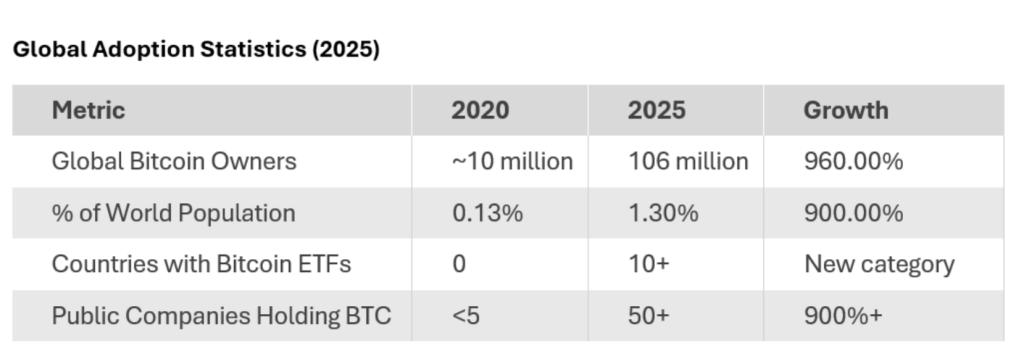

The Five-Year Transformation: From Geeks to Goldman

In 2020, if you mentioned Bitcoin at a bank, they’d probably escort you to the door. By 2025, those same banks are launching Bitcoin services and their investment arms are accumulating it by the hundreds of thousands.

MicroStrategy, a software company you probably never heard of, decided to go all-in on Bitcoin as their primary treasury asset. They’ve accumulated over 632,000 Bitcoin – that’s more than many entire countries’ gold reserves, except it’s digital and fits on a computer hard drive.

The Reality Check: What This Means for Regular People

Here’s what all these numbers really tell us:

The Good News: Bitcoin has gained institutional legitimacy. When BlackRock – the world’s largest asset manager – creates a Bitcoin fund, it signals that this isn’t just internet money for computer enthusiasts anymore.

The Concerning News: The concentration of ownership means that a relatively small number of entities control a large portion of the supply. This isn’t necessarily bad, but it’s worth understanding.

The Practical Reality: Only about 0.18% of cryptocurrency owners actually hold a full Bitcoin or more. With an estimated 106 million people worldwide holding some Bitcoin, that means fewer than 200,000 people own a complete Bitcoin.

Looking Forward: The Post-2030 Picture

Based on current trends, here’s what the crystal ball shows us:

- Institutional ownership will likely continue growing as more pension funds, insurance companies, and sovereign wealth funds allocate to Bitcoin

- Supply scarcity will intensify – with only 1.1 million Bitcoin left to mine and institutional demand running 6x higher than new supply

- Retail ownership may become more fractional – most people will own small portions rather than whole Bitcoin

The Bottom Line

Bitcoin ownership in 2025 looks nothing like it did five years ago. What started as a digital experiment among computer enthusiasts has become a legitimate asset class that attracts everyone from your neighbor’s college kid to the Norwegian government.

The concentration of ownership remains high, but that’s not necessarily different from other valuable assets – most of the world’s gold, real estate, and stocks are also concentrated among relatively few owners.

For those considering Bitcoin: Start small, learn as you go, and remember that you’re now participating in the same market as some of the world’s largest financial institutions. That’s both reassuring and slightly terrifying.

For the skeptics: The institutional adoption suggests this isn’t going away anytime soon. Whether that makes it a good investment is still an open question, but it’s clearly no longer a fringe experiment.

As I always say: whether you choose to buy Bitcoin or not, understanding who owns it helps you understand how this new form of money might evolve. And frankly, if you figured out online banking, you’re perfectly capable of understanding this too.

The data continues to evolve daily, but the trends are clear: Bitcoin has grown up, put on a suit, and moved to Wall Street. The question is whether that’s a good thing or just the natural evolution of any financial innovation that survives its teenage years.

Data as of 1st September 2025

Leave a Reply