Remember how we used to pay for things? If you’re old enough to recall rotary phones and TV antennas that needed constant adjusting, you’ve seen money transform several times in your lifetime. From cash and checks to credit cards and now digital payments on smartphones – it’s been quite a journey! But cryptocurrency might be the most fascinating evolution yet.

Money Through Time: A Quick Refresher

Think about the coins jingling in your pocket when you were a child. Those coins had actual value – pennies contained copper, quarters had silver. Money was tangible, something you could hold. Then came paper money, which essentially represented a promise: “This paper is worth X amount of gold or silver stored in a government vault.” For centuries, that’s how currency worked. But in 1971, something momentous happened that many of us lived through without realizing its significance: President Nixon took the U.S. dollar off the “gold standard.” Suddenly, our money wasn’t backed by gold anymore – it was valuable simply because the government said so and people believed it. Sound familiar? That’s surprisingly similar to how cryptocurrency works!

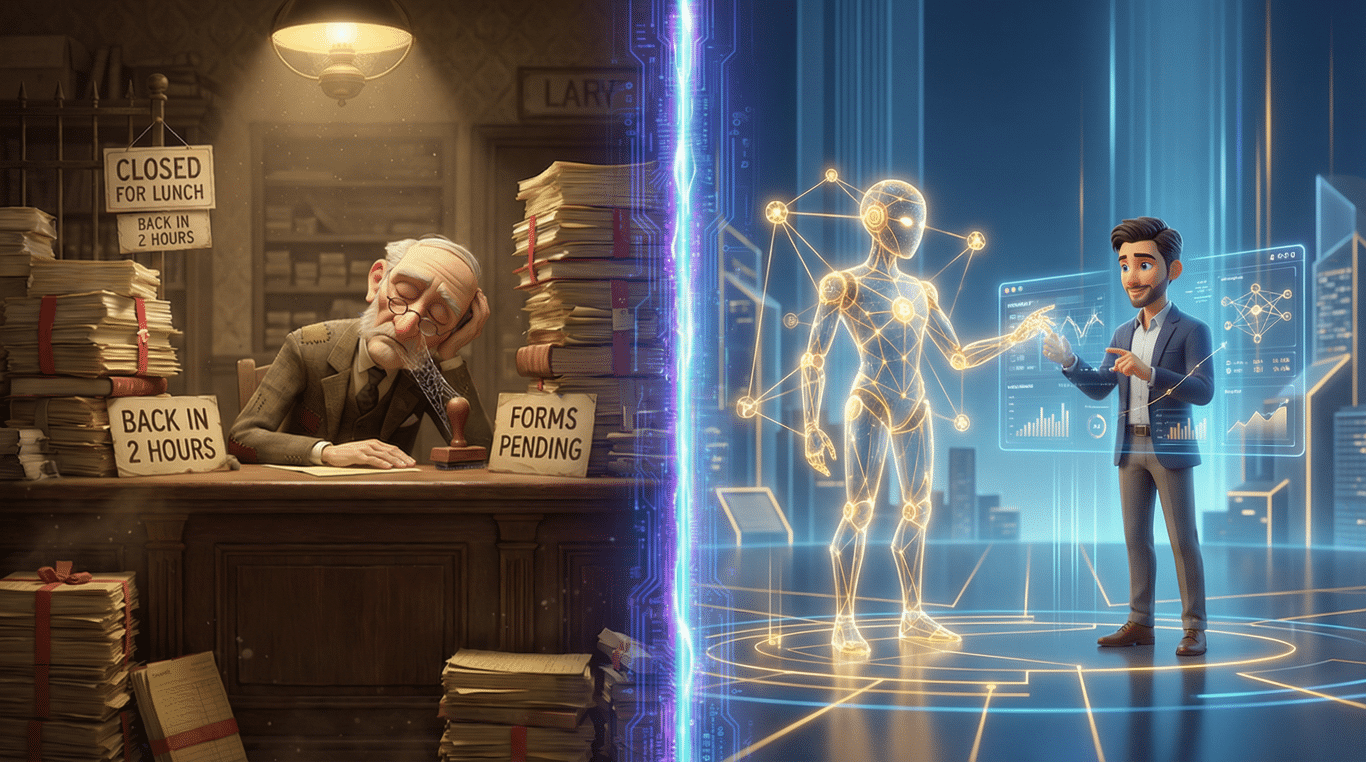

The Birth of Digital Money

By the 1990s, many of us were already using “digital money” without thinking about it. Remember your first ATM withdrawal? Or the first time you paid a bill online? Your dollars existed primarily as numbers on a screen. But there was still a crucial difference: banks and governments controlled all that digital money. They could track it, tax it, freeze it, or even create more of it (often leading to inflation that eroded our savings). This centralized control bothered some forward-thinking computer experts. They wondered: Could we create a form of digital money that works without banks or governments in the middle?

The Failed Attempts

Several early versions of digital currencies appeared in the 1990s. Remember companies like DigiCash and E-gold? Probably not, because they ultimately failed. The technology wasn’t quite ready, and the problem they were trying to solve – creating digital money that couldn’t be copied or “double-spent” without a central authority watching everything – seemed impossible.

Think of it this way: If I hand you a $20 bill, I no longer have it. But digital information can be copied endlessly – how do you prevent someone from copying their digital money and spending it multiple times?

Enter Bitcoin: The Breakthrough

In 2008, as many of us were watching our retirement accounts plummet during the financial crisis, a mysterious figure named Satoshi Nakamoto (we still don’t know who this is!) published a nine-page document titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

This paper outlined an ingenious solution to the digital money problem using three existing technologies in a new way:

- A decentralized ledger (the blockchain)

- Cryptography (advanced mathematics for security)

- A consensus mechanism (a way for everyone to agree on what’s true)

Here’s a simple analogy: Imagine if instead of each person having their own private checkbook, the entire town shared one giant ledger that recorded every transaction. Everyone gets a copy, everyone can see it, and it gets updated only when the majority agrees a transaction is legitimate. That makes cheating nearly impossible because everyone is watching!

How Bitcoin Made History

On January 3, 2009, Bitcoin’s first block was created. A few days later, Satoshi sent 10 Bitcoins to a computer programmer named Hal Finney in the first-ever Bitcoin transaction. Bitcoin’s early days were humble. In 2010, a programmer named Laszlo Hanyecz paid 10,000 Bitcoins for two pizzas – a transaction now celebrated as “Bitcoin Pizza Day.” Those pizzas would be worth hundreds of millions of dollars today!

To put this in perspective, imagine if you’d bought $100 worth of Bitcoin in 2010. That investment would be worth more than $200 million today. It’s enough to make anyone wish for a time machine!

Why People Got Excited About Cryptocurrency

Bitcoin introduced several revolutionary concepts:

Limited Supply: Unlike dollars, which governments can print endlessly, Bitcoin has a fixed supply of 21 million coins. This scarcity is programmed into its code.

Example: Think about baseball cards from the 1950s. They’re valuable today partly because there’s a limited number of them. Bitcoin works on a similar principle.

No Central Authority: No government or bank controls Bitcoin. It operates through a network of thousands of computers worldwide.

Example: It’s like having a community garden maintained by everyone who uses it, rather than a single gardener who can decide to plow it under whenever they want.

Borderless Transfers: Send value anywhere in the world without banks or wire services.

Example: Remember how complicated it was to send money to a relative in another country? With cryptocurrency, it’s like handing them cash directly, but through the internet.

From Bitcoin to Beyond

Bitcoin’s success inspired thousands of other cryptocurrencies, each with different features and purposes:

- Ethereum introduced “smart contracts” – self-executing agreements written in code

- Litecoin focused on faster transaction times

- Monero emphasized privacy

- Dogecoin started as a joke but gained a significant following

It’s like how we went from basic rotary phones to smartphones with countless apps – the core technology inspired endless innovation.

The Bumpy Road

Cryptocurrency’s history hasn’t been all smooth sailing. There have been dramatic price swings, security breaches, scams, and regulatory challenges.

In 2013, Bitcoin soared from $13 to over $1,000, only to crash back to around $200. It rose again to nearly $20,000 in 2017 before falling below $4,000. And in 2021, it reached heights above $60,000 before another significant correction.

This volatility is like: The early days of internet stocks in the 1990s – tremendous potential mixed with speculation, uncertainty, and dramatic ups and downs.

Where We Are Today

Today, cryptocurrency has grown from a niche interest to a significant financial force. Major companies like Tesla, PayPal, and Visa have embraced it. Financial institutions that once dismissed cryptocurrency are now offering it to clients.

Meanwhile, the technology continues to evolve. Newer systems address early concerns about energy usage and transaction speeds. Governments are developing regulations and even creating their own digital currencies.

The Lesson from History

If you’ve lived long enough to remember when phones had cords, you’ve witnessed many technological transitions: from vinyl records to streaming services, from encyclopedias to Wikipedia, from mail to email. Cryptocurrency represents a similar evolution in money. Whether it ultimately transforms global finance or simply influences how traditional systems evolve, understanding these developments gives you valuable insight into possible futures.

The wonderful thing about having lived through so many changes is the perspective it gives you. You know that new technologies can seem confusing at first, but often become second nature with time. And you’ve learned to separate genuine innovations from passing fads.

So whether you decide to dip your toe into cryptocurrency or simply understand it better to keep up with conversations at family gatherings, you’re part of witnessing an important chapter in the ongoing history of money.

Leave a Reply