NOTE: The data in this blog is correct as of 8th August 2025.

Remember when your kids told you the internet was just for nerds and criminals? Well, here we are – you’re probably reading this on that same “dangerous” internet while shopping online and video-calling your grandchildren. The same thing happened with Bitcoin, and it’s time we set the record straight about who’s really buying it these days.

The Dark Web Myth: A Classic Case of “Blame the Money”

Let’s start by busting the biggest myth: that Bitcoin is primarily used by criminals, drug dealers, and other unsavory characters on the “dark web.” Yes, Bitcoin did get early notoriety through sites like Silk Road – an online marketplace that operated from 2011 to 2013. But here’s the thing: blaming Bitcoin for criminal activity is like blaming the dollar bill because it’s used in drug deals.

Think about it this way – cash has been the preferred payment method for criminals for centuries. Does that make your wallet full of twenties inherently evil? Of course not.

The real reason Bitcoin got such bad press wasn’t because it was actually more criminal than cash – it was because governments and traditional banks were scared. Here was a form of money they couldn’t directly control, print more of, or shut down at will. So what did they do? They launched what you might call a good old-fashioned smear campaign.

The banking system didn’t like losing control, and neither did governments who suddenly faced a currency they couldn’t manipulate. It’s the same playbook we’ve seen before – remember when credit cards were “too dangerous” and online banking was “asking to be robbed”?

Remember when you had to balance your cheque book by hand? When you had to call the bank to verify if a cheque had cleared? The world of finance has changed dramatically, and blockchain technology is one of the latest innovations changing how we think about record-keeping. Let’s break it down in a way that makes sense, even if you’ve never dabbled in cryptocurrency before.

The Reality: Everyone’s Buying Bitcoin Now

Fast-forward to 2025, and the landscape has completely changed. The question isn’t “who’s buying Bitcoin?” anymore – it’s “who isn’t buying Bitcoin?”

HODL: The Philosophy That Changed Everything

Before we dive into the numbers, let me explain a term you’ll hear a lot: HODL. It started as a misspelling of “hold” in a 2013 forum post but became a philosophy – “Hold On for Dear Life.” The HODL mentality encourages long-term investment rather than panic selling during market downturns. This reflects a belief in Bitcoin’s long-term value proposition despite short-term volatility.

The HODLing Revolution

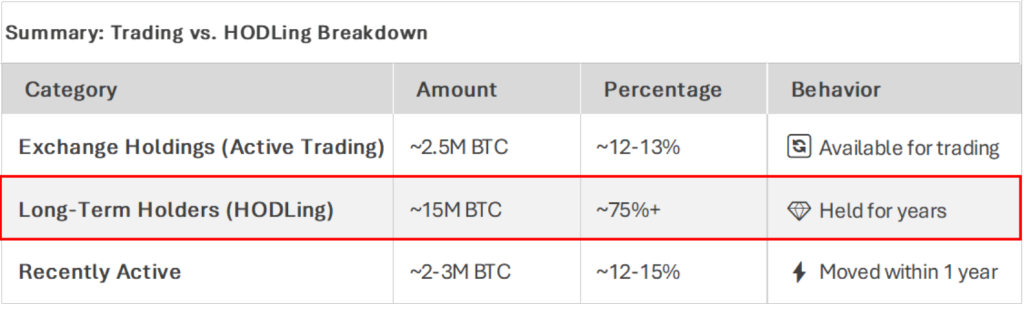

The data reveals that Bitcoin has evolved from a trading instrument to a store of value asset. The dramatic decrease in exchange balances combined with over 75% long-term holding shows that the HODL philosophy has become the dominant behavior.

This shift explains why Bitcoin’s price can be so volatile with relatively small trading volumes – when only 12-13% of the supply is actively available for trading, even modest changes in demand can create significant price movements.

The “Hold On for Dear Life” mentality that started as internet slang has become the primary investment strategy for the majority of Bitcoin holders, fundamentally changing the asset’s market dynamics from a speculative trading vehicle to a long-term store of value.

Over-The-Counter (OTC) Trading: How the Big Players Buy

When institutions want to buy large amounts of Bitcoin, they don’t just hop on a regular exchange like you or I might. They use Over-The-Counter (OTC) trading – private deals conducted directly between parties, often through brokers, outside of public exchanges. This helps prevent large trades from dramatically impacting market prices and provides the privacy and personalized service that big institutions require.

Who’s Buying Bitcoin Today: The Numbers Don’t Lie

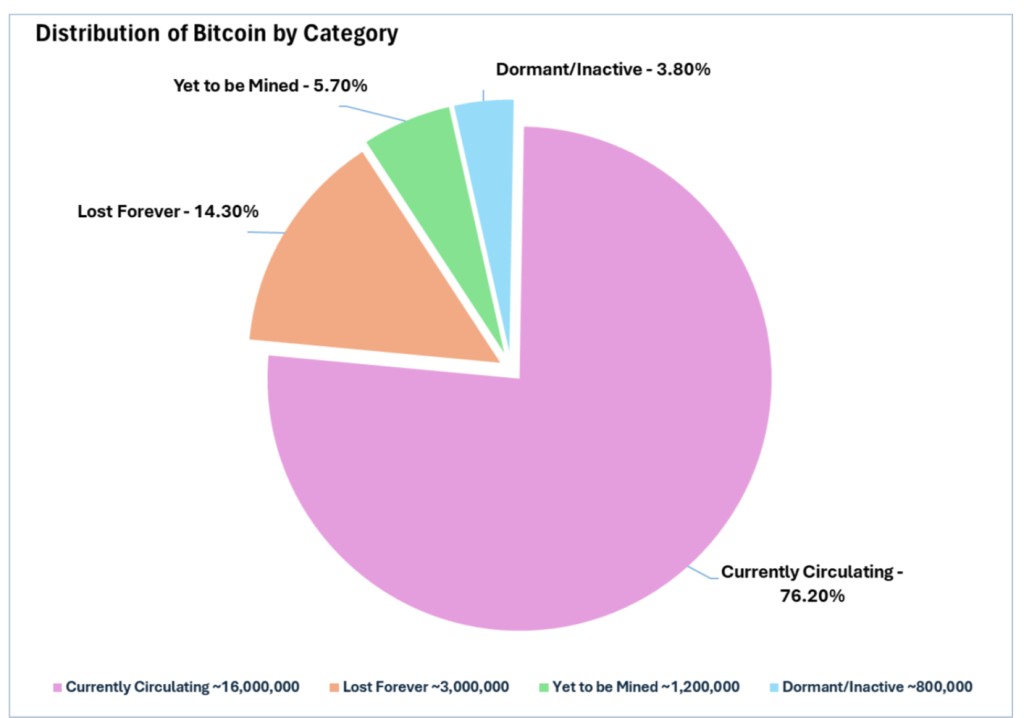

Remember there is a limited supply of bitcoin. Once its been mined that’s it, no way of printing or creating more… and we are nearly all mined..

Banking Sector Adoption

The banking world has done a complete 180. Here are the top financial institutions now involved:

Top 3 Bank Bitcoin Positions:

- JPMorgan Chase – Over $200 million in Bitcoin ETFs

- Morgan Stanley – $270 million in Bitcoin holdings

- Goldman Sachs – $418 million debut in spot Bitcoin ETF market (Q2 2024)

Recent Bank Activity (Last 6 Months):

- Goldman Sachs – Made their Bitcoin ETF debut with $418 million

- Wells Fargo – Expanding Bitcoin ETF initiatives

- Bank of America – Working on stablecoin launches and crypto integration

The Corporate Treasure Chest

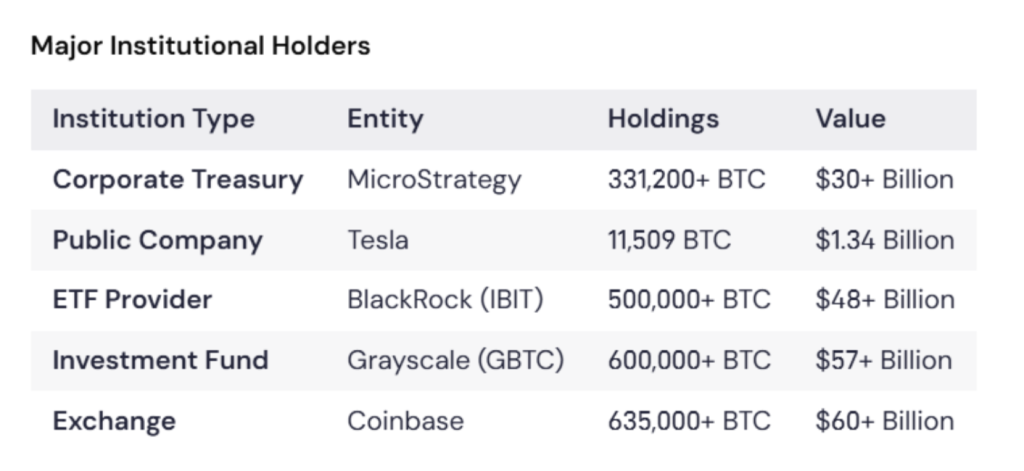

Companies aren’t just accepting Bitcoin anymore – they’re putting it on their balance sheets as a treasury asset.

Here’s why:

- Hedge against inflation – With governments printing money like it’s going out of style

- Store of value similar to gold

- Potential for significant returns – Bitcoin has outperformed nearly every traditional asset class

Top 3 Corporate Holders:

- MicroStrategy – 331,200+ BTC (the undisputed champion)

- Tesla – 11,509 BTC (Elon’s still holding)

- Marathon Digital Holdings – Major Bitcoin mining company

Top Recent Corporate Buyers:

- Semler Scientific – Added Bitcoin to treasury

- Riot Platforms – Continued accumulation

- Block (formerly Square) – Ongoing Bitcoin strategy

Retail Investors: The Backbone

Don’t think institutions are the whole story. Retail investors – regular folks like you and me – still make up a huge portion of Bitcoin holders. With apps like Cash App, PayPal, and Robinhood, buying Bitcoin is now as easy as ordering groceries online.

The beauty of Bitcoin’s transparency means we can track these flows in real-time. And what we see is consistent buying from all sectors of the economy.

The ETF Revolution

2024 marked a watershed moment with the approval of spot Bitcoin ETFs. BlackRock’s IBIT became the world’s largest Bitcoin fund with nearly $50 billion in assets. Professional investors with over $100 million under management now hold $27.4 billion worth of Bitcoin ETFs – a 114% increase from the previous quarter.

Major ETF Players:

- BlackRock (IBIT) – $48+ billion (Yes that’s THE BlackRock!!!!!)

- Fidelity (FBTC) – Major player in crypto ETF space

- Grayscale (GBTC) – The original, now competing with spot ETFs

“Bitcoin is an index of money laundering.” – Larry Fink, CEO of BlackRock

This famous quote was made by Larry Fink, CEO of BlackRock, during a CNBC interview on October 13, 2017515. The full context of his statement was that “Bitcoin just shows you how much demand for money laundering there is in the world”.

The Complete Reversal

What makes this quote particularly interesting is the complete 180-degree turn that followed:

- 2017: Fink called Bitcoin an “index of money laundering”

- 2024: BlackRock launched the world’s largest Bitcoin ETF (IBIT) with nearly $50 billion in assets

- Recent: Fink now calls Bitcoin “digital gold” and a “legitimate financial instrument“

So Why is everyone buying?: The Use Cases

Bitcoin today serves multiple purposes:

- Store of Value – Digital gold for the internet age

- International Remittances – Faster and cheaper than traditional banking

- Financial Inclusion – Banking for the 1.7 billion unbanked adults worldwide

- Portfolio Diversification – Uncorrelated asset for investment portfolios

- Corporate Treasury – Companies protecting against currency devaluation

Conclusion: It’s Not Just Geeks Anymore

The data tells a clear story: Bitcoin has gone mainstream. From governments adding it to their reserves, to Fortune 500 companies putting it on their balance sheets, to your neighborhood bank offering Bitcoin ETFs – this isn’t the fringe technology it once was.

The “criminals and nerds” narrative was always overblown, but now it’s completely obsolete. When JPMorgan – the same bank whose CEO once called Bitcoin a “fraud” – is holding hundreds of millions of dollars worth, you know the tide has turned.

Today’s Bitcoin buyers include:

- Sovereign wealth funds and governments

- Major corporations as treasury reserves

- Institutional investment managers

- Traditional banks and financial services

- Pension funds and endowments

- Retail investors through user-friendly apps

- High-net-worth individuals via OTC markets

The question isn’t whether Bitcoin is legitimate anymore – that debate ended when BlackRock, the world’s largest asset manager, launched a Bitcoin ETF. The question now is whether you want to be part of this financial evolution or watch from the sidelines.

Remember, you don’t have to buy a whole Bitcoin (they’re divisible to 8 decimal places). But understanding what’s happening in this space isn’t optional if you want to stay informed about where money and technology are heading.

The criminals didn’t adopt Bitcoin – Wall Street did. And that tells you everything you need to know about who’s really buying Bitcoin today.

Leave a Reply