When I first heard about cryptocurrency, I thought it was bonkers. People were spending actual money on digital coins that could lose half their value before you’d finished your morning coffee. Bitcoin would shoot up to ridiculous heights one day, then crash spectacularly the next. It was like watching someone ride a rollercoaster whilst trying to use their wallet. Madness, really.

But then stablecoins came along, and suddenly, the whole crypto thing started making a bit more sense. Think of stablecoins as the sensible cousin at the family gathering, the one who doesn’t get drunk and dance on tables. They’re the steady, reliable presence in a world of digital chaos.

Why Stablecoins Matter (More Than You Might Think)

Here’s the thing about money. We need it to be boring. I know that sounds odd, but bear with me. When you pop to Tesco and buy a loaf of bread for £1.20, you need to know that the pound in your pocket will still be worth roughly a pound tomorrow. You can’t have a functioning economy if your currency is bouncing around like a kangaroo on a trampoline.

That’s precisely the problem traditional cryptocurrencies faced. How could anyone actually use Bitcoin to buy things when it might be worth £30,000 today and £20,000 tomorrow? You’d never know if you were getting a bargain or being robbed blind.

Stablecoins solved this by doing something rather clever. They pegged their value to something stable, usually the US dollar or British pound. One stablecoin equals one dollar (or pound), today, tomorrow, and next week. Revolutionary? Not really. Practical? Absolutely.

This stability makes them incredibly important for the digital economy. They’ve become the bridge between traditional money and the wild west of cryptocurrency. They’re the translator at the international conference, making sure everyone can actually communicate and do business.

What Stablecoins Are Used For (And What They’re Not)

Let me paint you a picture. Imagine you’re sending money to your daughter who’s working in Australia. Using a traditional bank, you’d pay hefty fees, wait several days, and probably need to fill out forms that would rival War and Peace in length. With stablecoins, you can send the equivalent of pounds or dollars almost instantly, often for pennies in fees.

People use stablecoins for international transfers, for trading in and out of other cryptocurrencies without converting back to traditional money each time, and increasingly, for everyday transactions in countries where the local currency is about as stable as a three-legged chair. If you lived somewhere with runaway inflation, you’d want your savings in something that holds its value too.

Businesses use them for quick settlements, avoiding the delays of traditional banking. Some people even earn interest by lending their stablecoins out, though we’ll talk about the risks of that later.

Now, what aren’t they used for? Well, they’re not an investment in the traditional sense. You won’t get rich holding stablecoins because they’re designed not to increase in value. They’re meant to stay stable, remember? That’s literally in the name. They’re also not completely anonymous, despite what some people think about cryptocurrency. Most stablecoin transactions can be tracked, which is actually rather important for preventing dodgy dealings.

The World Before Stablecoins

Cast your mind back to the early 2010s. Bitcoin had arrived and people were excited, confused, and often both simultaneously. The promise was brilliant: digital money that no government controlled, that you could send anywhere in the world without banks taking their cut.

But there was this enormous problem. The volatility was absolutely bonkers. Early crypto traders faced a proper dilemma. Let’s say you’d made a profit trading Bitcoin and wanted to secure those gains. Your options were limited and frankly, rubbish. You could convert back to traditional currency, but that meant bank transfers, fees, delays, and often, you’d have to report it for taxes immediately. Then, if you wanted to buy back into crypto, you’d go through the whole process again. More fees, more waiting, more paperwork.

Some people just held their Bitcoin and hoped for the best, which was about as relaxing as juggling chainsaws. Others kept their money in exchanges, which was risky because exchanges got hacked with alarming regularity. We needed something better, something that combined the speed and flexibility of cryptocurrency with the stability of traditional money.

The Evolution of Stablecoins: From Concept to Reality

The first serious attempt at creating what are stablecoins came around 2014 with something called BitUSD. The idea was clever: create a cryptocurrency that maintained a stable value through some rather complex mechanisms involving collateral and smart contracts. It worked, sort of, but it was complicated and never really caught on with regular people.

Then in 2014, Tether launched USDT, and things got interesting. USDT took a much simpler approach: for every USDT token created, Tether claimed to hold one actual US dollar in reserve. Simple, right? One token, one dollar, backed by real money sitting in a bank account somewhere. This was the fiat-backed model, and it made sense to people. It was like the old days when currencies were backed by gold, except now it was digital tokens backed by dollars.

USDT became enormously popular, particularly for trading on cryptocurrency exchanges. If you wanted to sell your Bitcoin but didn’t want to convert to actual dollars, you’d sell it for USDT instead. You’d have stable value, but you’d still be in the crypto ecosystem, ready to jump back in when you wanted.

The benefit over earlier attempts was obvious: simplicity and trust. People understood the concept of reserves. It was familiar, like how banks used to work before everything became complicated.

But then people started asking awkward questions. Did Tether really have all those dollars in reserve? Were they being honest about their backing? This led to the next evolution: more transparent, regulated stablecoins.

Around 2018, we saw the emergence of stablecoins like USD Coin (USDC), created by regulated financial companies that provided regular audits and transparency reports. These were the “we’ve got nothing to hide” versions. They worked the same way as USDT, one token equals one dollar, but with more oversight and accountability. The benefit was trust, which, let’s face it, is rather important when we’re talking about money.

Then came another approach entirely: algorithmic stablecoins. These ambitious projects tried to maintain stable value without holding any reserves at all, using clever algorithms and incentive mechanisms instead. The most famous was TerraUSD (UST), which launched in 2020. The idea was brilliant in theory: use supply and demand mechanisms, a bit like how central banks manage currency, but automated and decentralized.

The benefit would have been enormous: a truly decentralized stable currency with no need to trust any company holding reserves. Unfortunately, in May 2022, it collapsed spectacularly, losing its peg to the dollar and wiping out billions in value. Turned out the algorithms weren’t quite as clever as everyone thought.

This brings us to today, where the market is dominated by fiat-backed stablecoins like USDT and USDC, with increased regulatory scrutiny and demands for transparency. We’ve learned, sometimes the hard way, that stability requires either solid backing or much cleverer mechanisms than we’ve managed to create so far.

How Stablecoins Actually Work: The Step-by-Step

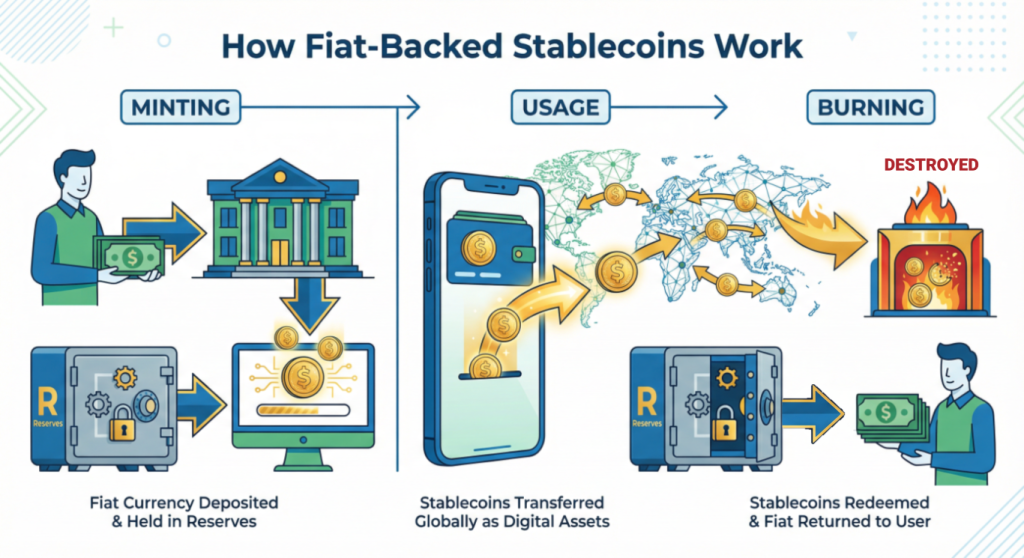

Let me walk you through how the most common type of stablecoin, the fiat-backed variety, actually works. I’ll use USDT as an example because it’s the most widely used.

First, imagine a company, let’s call it the Stablecoin Company (in reality, it’s companies like Tether or Circle). Someone approaches them with $1,000 and says, “I’d like some stablecoins, please.” The company takes that $1,000 and deposits it into their reserve account. Think of this reserve account as a giant vault where they keep all the backing money.

In exchange for those dollars, the company creates (or “mints,” in crypto-speak) 1,000 new stablecoin tokens and gives them to the customer. These tokens now exist on a blockchain, which is essentially a digital ledger that records who owns what. The blockchain keeps track of these tokens as they move around, just like a bank keeps track of transfers between accounts, except it’s all automated and transparent.

Now our customer has 1,000 stablecoins in their digital wallet. They can send these to anyone, anywhere in the world, almost instantly. The recipient can use them to buy things, trade them for other cryptocurrencies, or just hold onto them. Because everyone knows each token is backed by a real dollar in that reserve account, they trust that each token is worth one dollar.

When someone eventually wants to convert their stablecoins back to actual dollars, they go back to the Stablecoin Company and say, “Here are 500 tokens, I’d like my dollars back, please.” The company takes those 500 tokens and destroys them (or “burns” them, because everything in crypto needs dramatic terminology). Then they send the person $500 from the reserve account.

The system stays balanced because tokens are only created when money comes in and destroyed when money goes out. The number of tokens in circulation should always match the amount of money in reserves. That’s the theory, anyway.

For algorithmic stablecoins, the process is more complex and involves smart contracts (automated programs) that try to maintain the price through various mechanisms. But given what happened to TerraUSD, I’d say that approach needs more work before anyone should trust it with serious money.

The Future of Stablecoins: Where We’re Heading

I reckon stablecoins are going to become increasingly mainstream over the next decade. We’re already seeing major financial institutions getting involved, creating their own versions or partnering with existing stablecoin companies. Banks are starting to realize that this technology isn’t going away, and they’d better adapt or risk becoming irrelevant.

Governments are paying attention too, which is both good and concerning. Good because regulation can provide protection and legitimacy. Concerning because, well, governments and innovation don’t always play nicely together. Several countries are developing their own digital currencies, called Central Bank Digital Currencies (CBDCs), which are essentially government-issued stablecoins.

I suspect we’ll see stablecoins used more for everyday payments. Imagine paying for your shopping with a stablecoin linked to pounds, getting instant settlement, minimal fees, and a clear record of the transaction. That’s not science fiction, it’s entirely possible with current technology.

The challenge will be making it simple enough for everyone to use. Right now, dealing with digital wallets and blockchain addresses is about as user-friendly as programming a VCR was in the 1980s. We need better interfaces, better security, and better education.

We’ll likely see more stablecoins pegged to different currencies too. Why should the dollar dominate? Pound-based, euro-based, and yen-based stablecoins could serve their respective markets better.

Security and Vulnerabilities: The Serious Bit

Right, I need to be straight with you about this because it’s important. Stablecoins, like any financial technology, come with risks. Just because they’re designed to be stable in value doesn’t mean they’re safe from other problems.

First, there’s the counterparty risk. When you hold stablecoins, you’re trusting that the company issuing them actually has the reserves they claim. If they’re lying, or if they’ve invested those reserves in risky assets that go bad, your stablecoins could become worthless. This isn’t theoretical. There have been serious questions about whether some stablecoin issuers really have full backing.

Then there’s the technology risk. Stablecoins exist on blockchains, and those blockchains can have vulnerabilities. Smart contracts can have bugs. If you send stablecoins to the wrong address, there’s no customer service number to call. The transaction is permanent and irreversible. I know someone who lost a substantial amount this way, and it was heartbreaking.

Exchanges where you might buy or store stablecoins can be hacked. It’s happened before, it’ll happen again. If your stablecoins are sitting on an exchange and that exchange gets compromised, you could lose everything. This is why people say “not your keys, not your coins,” meaning if you don’t control the private keys to your wallet, you don’t really control your money.

Regulatory risk is real too. Governments could decide to crack down on stablecoins, particularly ones that aren’t fully compliant with financial regulations. If a stablecoin gets banned or heavily restricted, its value and usefulness could plummet.

There’s also the risk of de-pegging, where a stablecoin loses its connection to the asset it’s supposed to track. We saw this with TerraUSD, but even established stablecoins have briefly lost their peg during market stress. Usually, they recover, but “usually” isn’t the same as “always.”

My advice? If you’re going to use stablecoins, do your homework. Stick with the established, transparent ones that provide regular attestations of their reserves. Don’t keep more in stablecoins than you can afford to lose. Use hardware wallets or reputable custody solutions rather than leaving everything on exchanges. And for goodness’ sake, double-check addresses before sending transactions.

Wrapping This Up

So, what are stablecoins? They’re the sensible answer to cryptocurrency’s biggest problem: volatility. They’re digital currencies designed to maintain a stable value, usually by being backed by traditional currencies like the dollar or pound. They’ve evolved from complex early experiments to the relatively straightforward fiat-backed versions that dominate today, with a few spectacular failures teaching us important lessons along the way.

They’re useful for international transfers, for moving in and out of cryptocurrency investments, and increasingly, for everyday transactions. They’re not useful for getting rich quick, because they’re designed to stay stable, not grow in value.

The future looks bright, with increasing adoption and integration into mainstream finance. But they’re not without risks. The technology is still relatively new, regulations are still being worked out, and you need to be careful about security and choosing reputable providers.

I think stablecoins represent something genuinely useful in the financial technology landscape. They’re not perfect, and they’re certainly not a replacement for traditional money in all situations. But they’ve carved out a valuable niche, solving real problems for real people.

Just remember: stable doesn’t mean safe, and digital doesn’t mean invincible. Approach stablecoins with the same caution you’d approach any financial product. Do your research, understand what you’re getting into, and never invest more than you can afford to lose.

And if anyone tries to sell you on an algorithmic stablecoin promising amazing returns with no backing, remember what happened to TerraUSD and run in the opposite direction. Some lessons, we really should only need to learn once.

Walter

Leave a Reply