Look, I’m going to level with you. My first reaction to RWA tokenization was that it was total jargon invented by someone trying to sound smart at a dinner party. Real world asset tokenization? It sounded like the kind of thing my nephew would explain to me while I nodded politely and wondered if I was getting too old for this.

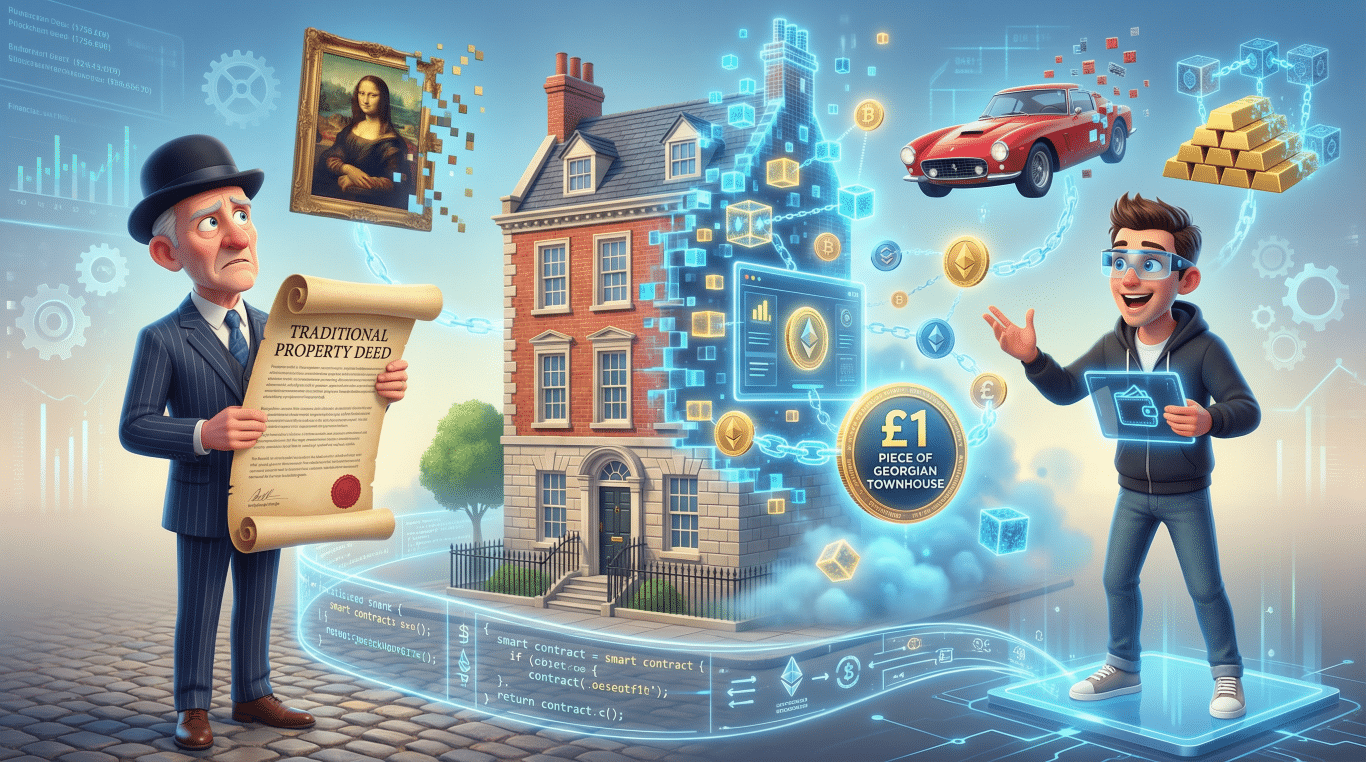

But here’s the thing. This technology is actually brilliant, and it’s not nearly as complicated as it sounds. In fact, once you understand it, you’ll wonder why we didn’t think of it sooner. It’s basically taking things we own in the real world, like property, art, or even that classic car gathering dust in your garage, and turning them into digital tokens that can be bought, sold, and traded online. Think of it like converting your vinyl records into digital music files, except instead of songs, we’re talking about actual valuable assets.

Why RWA Tokenization Matters

Let me paint you a picture. Remember when you wanted to invest in property but didn’t have £200,000 lying about for a deposit? Or when you fancied owning a piece of that gorgeous Georgian townhouse in Bath but couldn’t afford the whole building? That’s exactly the problem asset tokenization solves.

The technology is important because it’s democratising investment. It’s taking assets that were previously only available to the wealthy and slicing them up into affordable pieces. Imagine a £5 million commercial property being divided into 5 million tokens at £1 each. Suddenly, you can own a piece of prime real estate for the same price as your morning coffee.

But it’s more than just making investments accessible. RWA tokenization is creating liquidity (how quickly you can turn something into cash without losing value) where there was none before.

Before tokenization = A house is illiquid. You want your money out? Tough luck. Months of estate agents, surveys, solicitors, negotiating with buyers. It’s painful.

After tokenization = That same house (or your chunk of it) becomes liquid. You own a token representing your share. Want to sell? Minutes. You can offload it like you’d offload shares in M&S.

What It’s Used For (And What It’s Definitely Not)

Real world asset tokenization works brilliantly for things that are valuable but traditionally difficult to buy, sell, or divide. Property is the obvious one. Commercial buildings, residential flats, even agricultural land. All perfect candidates.

Then there’s art. That Banksy you’ve been eyeing? Instead of needing £500,000, you might buy a 1% share for £5,000. Collectibles like rare whisky, vintage wines, classic cars. They’re all being tokenized. Even commodities like gold and silver are getting the treatment, though they’ve always been easier to trade anyway.

But here’s what it’s not used for, and this is important. It’s not for things that are already easy to trade. Your savings account? Doesn’t need tokenizing. Shares in public companies? Already digital and liquid, thank you very much. And despite what some enthusiastic crypto types might tell you, it’s not a magic solution for everything. You can’t tokenize your grandmother’s secret recipe (well, you could, but why would you?).

It’s also not meant to replace traditional ownership entirely. Think of it as an additional option, not a replacement. Some things are still better handled the old-fashioned way, and that’s perfectly fine.

The World Before Tokenization

Cast your mind back to, well, pretty much any time before 2017. If you wanted to invest in real assets, you had limited options. You could buy an entire property, which required serious capital and a mortgage that would haunt you for decades. You could invest in a Real Estate Investment Trust (REIT), but that was like buying a pre-packaged meal when you wanted to choose your own ingredients.

For art and collectibles, you were even more stuck. Either you had the money to buy the whole thing, or you didn’t. There were some investment funds for fine art, but they were typically only available to high-net-worth individuals. The minimum investment might be £100,000, and you’d be locked in for years. It was an exclusive club, and most of us weren’t invited.

The paperwork was phenomenal. I once helped my sister buy a flat, and the legal documentation could have stopped a door in a hurricane. Every transaction required solicitors, notaries, land registries, and enough signatures to give you writer’s cramp. It took three months and cost thousands in fees.

Selling was even worse. If you needed to cash out your investment quickly, tough luck. Property takes months to sell. Art might take years to find the right buyer. You were stuck, and liquidity was a distant dream.

The Evolution of Asset Tokenization

The story of RWA tokenization really begins with Bitcoin in 2009, though Bitcoin itself wasn’t about tokenizing real assets. It was about creating digital money. But it gave us blockchain technology, which is the foundation everything else is built on.

Think of blockchain as a digital ledger that everyone can see but no one can cheat. It’s like having a community noticeboard where everyone watches everyone else, making sure no one’s writing fibs.

Then came Ethereum in 2015, and this was the game-changer. Ethereum introduced smart contracts, which are basically self-executing agreements written in code. Imagine a vending machine. You put money in, press a button, and you automatically get your crisps. No shopkeeper needed. Smart contracts work the same way, but for complex transactions.

The first real attempts at tokenizing assets started around 2017 and 2018. They were clunky, honestly. The technology worked, but the legal framework was murky. Was a token representing property actually property? Could you enforce ownership rights? Regulators were scratching their heads, and investors were understandably nervous.

Early platforms tried tokenizing everything from property to diamonds. Some succeeded modestly. Many failed spectacularly. The problem wasn’t the technology, it was everything around it. Legal recognition, regulatory compliance, investor protection. These things take time to develop.

By 2020 and 2021, things started maturing. Regulations began catching up. The Financial Conduct Authority in the UK started providing clearer guidance. Other countries did the same. Platforms became more sophisticated, offering better security and user experience.

The big shift came when traditional financial institutions got involved. When JPMorgan and Goldman Sachs start playing with tokenization, you know it’s becoming mainstream. They brought credibility, regulatory expertise, and serious capital.

Now, in 2025, we’re seeing what I’d call the practical phase. The technology works. The regulations exist (mostly). The platforms are user-friendly. It’s not perfect, but it’s genuinely usable. We’ve moved from “interesting experiment” to “actual investment option.”

How RWA Tokenization Actually Works

Right, let’s walk through this step by step. I promise it’s simpler than programming your video recorder (remember those?).

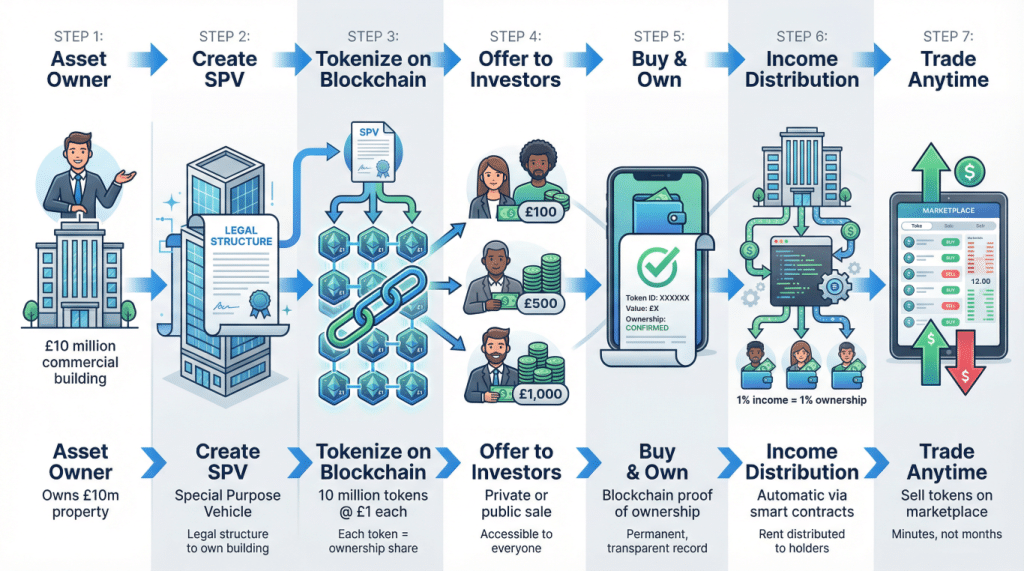

First, someone needs to own an asset they want to tokenize. Let’s say it’s a commercial building worth £10 million. The owner decides they want to raise money by selling shares in the property without giving up complete control.

They partner with a tokenization platform. These platforms are like estate agents meets tech companies. They handle the technical side and often the legal side too. The platform conducts due diligence, making sure the property actually exists and is worth what the owner claims. They’ll get valuations, legal opinions, all that sensible stuff.

Next comes the legal structure. This is crucial. You can’t just wave a wand and turn a building into digital tokens. You need a legal entity, typically a special purpose vehicle or SPV. Think of it as creating a company whose only job is to own this one building. The tokens then represent shares in that company.

The tokens themselves are created on a blockchain. Each token represents a specific percentage of ownership. Our £10 million building might be divided into 10 million tokens at £1 each. The smart contract governing these tokens includes all the rules. Who can buy them? How are profits distributed? What happens if someone wants to sell?

Once created, the tokens are offered to investors. This might be through a private sale or a public offering, depending on the regulations and the platform. You, as an investor, can buy as many or as few tokens as you want (subject to minimums set by the platform).

When you buy tokens, the transaction is recorded on the blockchain. This is your proof of ownership. It’s permanent, transparent, and can’t be altered. You don’t get a paper certificate, you get a digital record that’s arguably more secure than any paper could be.

If the property generates income, say from rent, that income is distributed to token holders automatically through smart contracts. If you own 1% of the tokens, you get 1% of the distributable income. No waiting for cheques in the post, no wondering if the accountant remembered you. It just happens.

When you want to sell your tokens, you can list them on the platform’s marketplace. Another investor can buy them, and the blockchain updates to reflect the new ownership. In theory, this happens in minutes. In practice, it depends on the platform and the demand for that particular asset.

The Future of Real World Asset Tokenization

I’ve been watching this space for a while now, and I genuinely believe we’re at the beginning of something significant. Not revolutionary in a dramatic, overnight sense. More like the slow revolution of online banking, which seemed odd at first and now feels completely normal.

The market is growing rapidly. Some analysts predict the tokenized asset market could reach several trillion dollars in the next decade. That’s not pocket change. We’re seeing more traditional assets being tokenized. Government bonds, corporate debt, infrastructure projects. Things that were previously the exclusive domain of institutional investors are becoming accessible to regular people.

I think we’ll see tokenization become as normal as online banking. Your investment portfolio might include traditional shares, some bonds, and a few tokenized assets, all managed through the same app. The distinction between “traditional” and “tokenized” will blur until it’s just different types of investments.

Regulation will continue improving. The UK is actually quite forward-thinking here. The government has been working on frameworks to support digital assets while protecting investors. Other countries are doing the same. As regulations become clearer and more consistent internationally, investor confidence will grow.

We’ll also see new types of assets being tokenized. Intellectual property, music royalties, even future earnings from athletes or entertainers. Some of this sounds barmy, I know. But so did the idea of buying books online in 1995, and look how that turned out.

The technology itself will improve. Transactions will become faster and cheaper. User interfaces will get simpler. Your mum will be able to buy tokenized assets without needing to call you for help (though she probably still will, because that’s what mums do).

Security and Vulnerabilities (The Serious Bit)

Now, I need to put on my serious hat for a moment because this matters. Asset tokenization offers genuine opportunities, but it’s not without risks. You need to understand these before putting your money anywhere near this technology.

First, the technology itself can be vulnerable. Blockchain is generally secure, but the platforms built on top of it aren’t always. We’ve seen hacks, we’ve seen scams, we’ve seen platforms disappear overnight with investors’ money. Not frequently, but it happens. Always research the platform thoroughly. Look for ones that are regulated, audited, and have been around for a while.

Smart contracts, while clever, are only as good as their code. Bugs in smart contracts have cost investors millions. A single error in the code can create vulnerabilities that hackers exploit. Reputable platforms have their smart contracts audited by independent security firms, but it’s not foolproof.

Then there’s the question of the underlying asset. Just because something is tokenized doesn’t mean it’s valuable. A token representing a worthless painting is still worthless. You need to do the same due diligence you’d do for any investment. Is the asset real? Is the valuation accurate? Are there any liens or legal issues?

Liquidity isn’t guaranteed. Yes, tokenization can make assets more liquid, but only if there are buyers. You might own tokens in a lovely property in Manchester, but if no one wants to buy them, you’re stuck. The secondary market for tokenized assets is still developing, and it’s not as liquid as, say, the stock market.

Regulatory risk is real. The rules around tokenized assets are still evolving. A change in regulation could affect the value of your tokens or your ability to sell them. Countries might ban certain types of tokenized assets or impose restrictions. You’re investing in a space where the rules aren’t fully written yet.

There’s also the custody question. Where are your tokens stored? If they’re in a digital wallet you control, you need to keep your private keys secure. Lose them, and you’ve lost your investment. If the platform holds them for you, you’re trusting that platform not to get hacked or go bankrupt.

My advice? Start small. Don’t invest money you can’t afford to lose. Stick with regulated platforms. Diversify, don’t put everything into tokenized assets. And for heaven’s sake, read the documentation. I know it’s boring, but so is losing money.

Wrapping This Up

So there we are. Real world asset tokenization is taking things we own in the physical world and converting them into digital tokens that can be bought, sold, and traded more easily than ever before. It’s making investments accessible to ordinary people that were previously only available to the wealthy. It’s creating liquidity in markets that had none. And it’s merging traditional finance with decentralized finance in ways that are genuinely useful.

We’ve come a long way from the early, clunky attempts at RWA tokenization in 2017 and 2018. The technology has matured, regulations are catching up, and traditional financial institutions are getting involved. In 2025, this isn’t some wild experiment anymore. It’s becoming a legitimate part of the investment landscape.

Does that mean you should rush out and tokenize your house? Probably not. Should you put your life savings into tokenized assets? Definitely not. But should you understand what asset tokenization is and how it works? Absolutely. Because this technology is changing how we think about ownership and investment, and it’s not going away.

The future looks interesting. More assets will be tokenized, the technology will improve, and the regulatory framework will solidify. What seems exotic today will feel normal tomorrow. Just like online banking, just like buying things on Amazon, just like video calls with your grandchildren.

But remember, with opportunity comes risk. The platforms can be hacked, the regulations can change, and the assets underlying the tokens need to be genuinely valuable. Do your homework, start small, and never invest more than you can afford to lose.

RWA tokenization isn’t magic. It’s technology applied to old problems in new ways. Sometimes it works brilliantly. Sometimes it doesn’t. But it’s here, it’s growing, and it’s worth understanding. Even if, like me, you initially thought it was just someone making up words at a dinner party.

Walter

Note: This article is for educational purposes only and does not constitute financial, investment, or legal advice. Market projections and future predictions are inherently uncertain. Regulatory landscape varies by jurisdiction. Readers should verify current regulations in their specific location and consult with qualified financial advisors before making any investment decisions. Past performance or theoretical models do not guarantee future results, and all investments carry risk of partial or total loss.

Leave a Reply