When I first heard about DeFi, I thought someone was trying to sell me a new type of high-fibre breakfast cereal. Turns out, it’s actually something far more interesting, and potentially more important than your morning bowel movements. DeFi, short for decentralized finance, is reshaping how we think about money, banks, and the entire financial system. And no, you don’t need to be a computer whiz or a City trader to understand it.

Why DeFi Matters (And Why You Should Care)

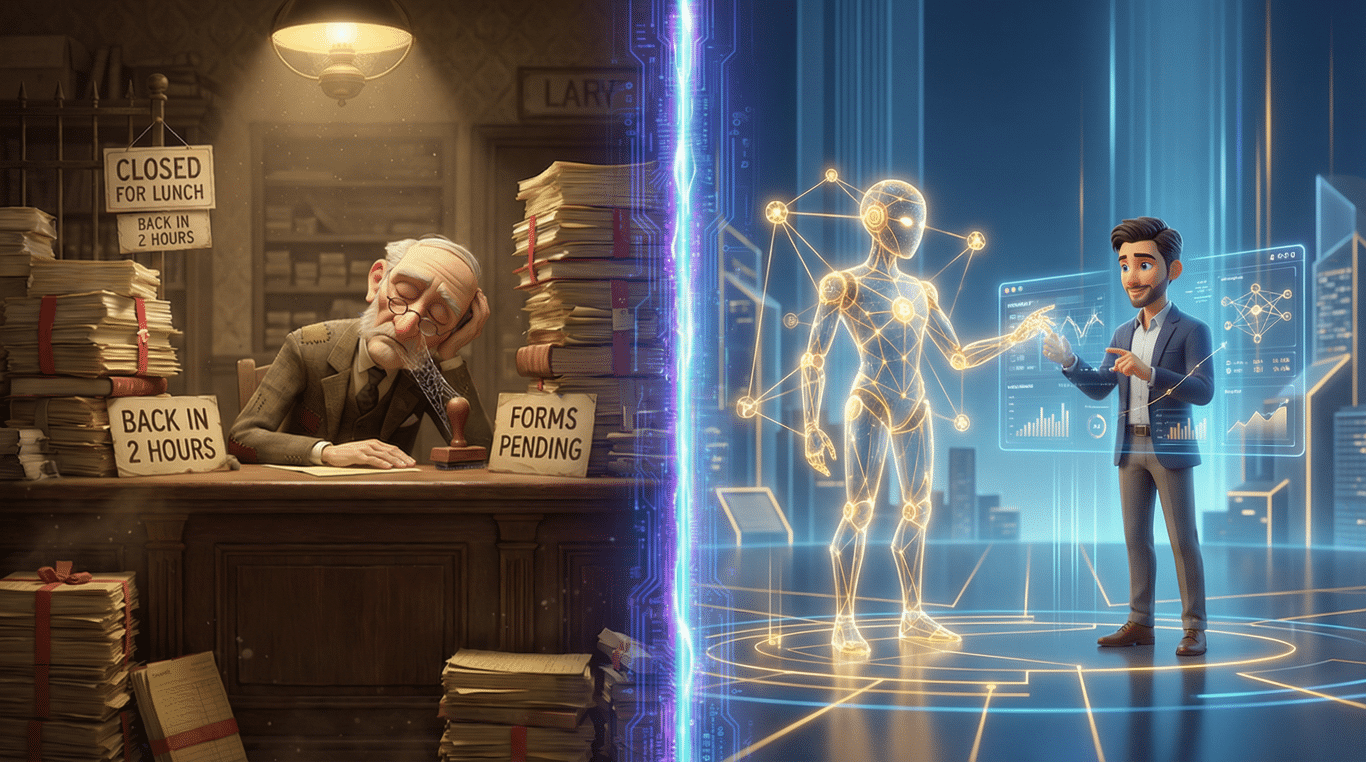

Remember when you had to physically go to a bank branch to do anything? Queue for twenty minutes, fill out forms in triplicate, wait three to five working days for a transfer? Well, we’ve come a long way since then, but we’re still essentially playing by the same rules. Your bank still controls your money. They decide when you can access it, how much you can send, and to whom. They charge you fees for the privilege. And if they decide to close on a Sunday, tough luck.

DeFi is important because it’s proposing something radical: what if we could have all the services a bank provides, loans, savings accounts, insurance, investments, without actually needing the bank? What if, instead of trusting a massive institution with your money, you could trust mathematics and computer code? I know that sounds bonkers, but stick with me.

The technology matters because it’s democratizing finance. It’s opening doors that were previously locked to ordinary people. It’s making financial services available 24/7, globally, to anyone with an internet connection. No credit checks, no discrimination, no gatekeepers in expensive suits deciding whether you’re worthy of their services.

What DeFi Is Actually Used For (And What It Isn’t)

So, what is DeFi in practical terms? Think of decentralized finance as a collection of financial services that run on the internet, without a company or bank in the middle.

People use DeFi for lending and borrowing money. Imagine lending your mate fifty quid, but instead of your mate, it’s strangers on the internet, and instead of a handshake, it’s secured by computer code. You can earn interest on your cryptocurrency (digital money, basically) by lending it out, often at rates that make your building society account look like a joke.

People use it for trading. You can swap one type of cryptocurrency for another without going through a traditional exchange. It’s like having a bureau de change that never closes and doesn’t charge you extortionate commission.

They use it for savings accounts that actually pay decent interest. They use it for insurance. They use it for investing in projects they believe in.

But here’s what DeFi isn’t used for, and this is important. It’s not really used for your everyday spending. You can’t pop to Tesco and pay for your groceries with most DeFi services. It’s not replacing your current bank account, not yet anyway. It’s not particularly user-friendly if you’re not comfortable with technology. And it’s definitely not a get-rich-quick scheme, despite what some excitable people on the internet might tell you.

The Before Times: Traditional Finance

Let me take you back. Not too far, don’t worry, I’m not going to bang on about the Medicis or whatever. Just back to the financial system we’ve all grown up with.

For centuries, we’ve had what’s called centralized finance. Banks, building societies, insurance companies, all the big institutions. You deposit your money with them, they promise to keep it safe, and they use it to make more money for themselves (lending it out at higher rates than they pay you, investing it, that sort of thing). You trust them because they’re regulated, they have big buildings, and the government guarantees your deposits up to a certain amount.

This system works, sort of. It’s stable, mostly. But it’s also slow, expensive, and exclusive. Try sending money internationally and you’ll pay through the nose for the privilege. Try getting a loan with a dodgy credit history and you’ll be laughed out of the building. Try accessing banking services in developing countries and you might find there simply aren’t any available.

The 2008 financial crisis showed us something else too. These trusted institutions could fail spectacularly, and when they did, ordinary people paid the price. That crisis, more than anything else, planted the seeds for what came next.

A Brief History of DeFi

The story really begins in 2009 with Bitcoin. Now, Bitcoin isn’t DeFi exactly, but it’s the grandfather of the whole movement. Some person or group called Satoshi Nakamoto (still anonymous, very mysterious) created the first cryptocurrency. The key innovation was the blockchain, a sort of digital ledger that everyone could see but no one could cheat. It proved you could have money without banks.

But Bitcoin was just digital money. It couldn’t do much beyond being sent from person to person. Then in 2015, along came Ethereum, created by a young programmer called Vitalik Buterin. Ethereum was different. It was a blockchain that could run programs, what they call “smart contracts.” These are basically agreements written in code that execute automatically when certain conditions are met. If X happens, then Y happens. No lawyers, no middlemen, just code.

This is when things got interesting. Developers realized they could use these smart contracts to recreate financial services. The first major DeFi application was MakerDAO, launched in 2017. It allowed people to borrow money against their cryptocurrency without a bank approving the loan. The smart contract handled everything automatically.

Then came the explosion. In 2020, what people call “DeFi Summer” happened. Suddenly, there were hundreds of DeFi applications. Compound let you lend and borrow. Uniswap let you trade cryptocurrencies without a centralized exchange. Aave offered flash loans (don’t worry about what those are, they’re properly complicated). The total value locked in DeFi protocols went from about a billion dollars to over a hundred billion in the space of a few years.

Each generation of DeFi has built on the previous one. Early versions were clunky and expensive to use. Newer versions have become faster and cheaper, though they’ve also become more complex. The benefit over traditional finance has remained consistent though: no gatekeepers, 24/7 access, and transparency. Everything happens on the blockchain where anyone can see it (though your identity remains private).

How DeFi Actually Works (The Simple Version)

Right, let’s walk through how this actually works. I’m going to use a lending example because it’s the easiest to understand.

Let’s say you own some cryptocurrency, specifically Ethereum. You don’t want to sell it, but you need some cash. In the traditional world, you’d go to a bank, they’d assess your creditworthiness, probably say no, and you’d be stuck.

In the DeFi world, you go to a lending platform like Aave or Compound. You connect your digital wallet (think of it as a secure app that holds your cryptocurrency). You deposit your Ethereum as collateral, like putting something in a pawnshop. The smart contract automatically calculates how much you can borrow based on the value of your collateral, usually you can borrow up to about 75% of what you’ve deposited.

You take out the loan. The money appears in your wallet instantly. No credit check, no approval process, no waiting. The smart contract holds your Ethereum safely. You pay interest on the loan, which goes to people who have deposited money into the lending pool (they’re earning interest on their deposits).

When you’re ready, you pay back the loan plus interest. The smart contract automatically releases your Ethereum back to you. If you don’t pay back the loan and the value of your collateral drops too low, the smart contract automatically sells some of your Ethereum to pay back the loan. It’s all automated, all transparent, all happening without a single human being making decisions.

The beauty is that the lenders don’t know who you are, and they don’t care. They’re protected by the collateral and the smart contract. You don’t know who they are either. The code handles everything.

What Applications make up the DeFi Ecosystem

Right then, listing all the DeFi applications is a bit like asking for a list of every pub in London. There are thousands, and honestly, half of them are rubbish or straight-up scams.

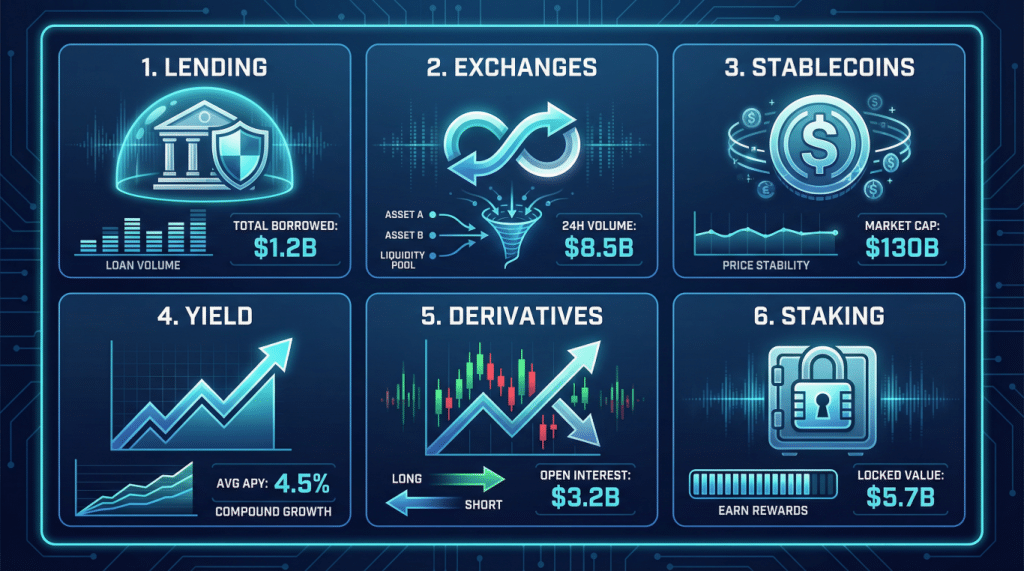

But, if we stick to the ones that people actually use (and haven’t collapsed yet), we can break them down by what they actually do. Here are the big players you’ll hear about, categorised so they make sense:

1. The “Robo-Banks” (Lending & Borrowing)

These are the protocols mentioned in the article where you deposit cash to earn interest or borrow against it.

- Aave: Probably the biggest one. It’s like a massive liquidity pool. You throw your crypto in, you get interest. You need a loan? You lock up some collateral and take cash out.

- Compound: Very similar to Aave. It was one of the first to offer “governance tokens” (basically giving you shares in the company just for using it), which kicked off the whole craze in 2020.

2. The “Robot Bureau de Change” (Decentralized Exchanges or DEXs)

These let you swap one coin for another without a middleman.

- Uniswap: The heavyweight champion. It uses a mathematical formula to set prices rather than an order book. It’s where most new coins launch.

- Curve: Specialist exchange designed specifically for “stablecoins” (coins pegged to the Dollar or Euro). It’s designed to swap money with very low fees and very little price slippage.

- SushiSwap: Started as a direct clone of Uniswap (with a bit of drama), but added extra features like lending and yield farming. Yes, DeFi loves food names.

3. The “Money Printers” (Stablecoins)

- MakerDAO: This is the OG. It manages a coin called DAI. It’s a “stablecoin” pegged to the US Dollar. Unlike other stablecoins run by companies (like Tether), DAI is run by code. You lock up Ethereum in a vault, and the system prints DAI for you to use.

4. The “Savings Maximisers” (Yield Aggregators)

- Yearn Finance: This is for the lazy (or efficiency-obsessed) investor. You deposit your money, and Yearn’s code automatically moves it around different lending protocols (like Aave or Compound) to find the absolute highest interest rate at that exact second. It’s basically an automated financial advisor.

5. The “Casinos” (Derivatives & Trading)

- dYdX: This is for people who want to trade with “leverage” (betting with borrowed money). It feels more like a traditional trading app but runs on code.

- Synthetix: This lets you create digital versions of real-world assets. Want to bet on the price of Gold or Tesla stock using crypto? You do it here.

6. The “Have Your Cake and Eat It” (Liquid Staking)

- Lido: This is huge right now. Usually, to earn interest on Ethereum, you have to lock it away so you can’t touch it. Lido lets you lock it away but gives you a “receipt” token (stETH) that you can still go and spend or lend elsewhere.

A word of warning: Just because these are the “big” names doesn’t mean they are safe. In this world, “established” just means “hasn’t been hacked… yet.”

What’s Next: The Future of Decentralized Finance

Now, I’m not a fortune teller, and anyone who claims to know exactly where DeFi is heading is selling you something. But I can see some trends emerging.

First, DeFi is going to get easier to use. Right now, it’s still quite technical. You need to understand wallets, gas fees, different blockchains. The next generation of applications will hide all that complexity. You’ll interact with DeFi without even realizing you’re using blockchain technology, the same way you use the internet without thinking about TCP/IP protocols.

Second, we’re going to see more integration with traditional finance. Banks are already experimenting with DeFi technology. They can see the writing on the wall. We might end up with a hybrid system where traditional and decentralized finance coexist and complement each other.

Third, regulation is coming. Governments aren’t going to let a parallel financial system operate without oversight. This might actually be good for DeFi’s mainstream adoption. Regulation provides clarity and protection, even if it reduces some of the wild-west freedom that early adopters enjoyed.

We’re also likely to see DeFi expand beyond cryptocurrency. Imagine using these same principles for real estate transactions, for managing your pension, for insurance claims. The technology is adaptable.

Security and Vulnerabilities: The Serious Bit

I need to be straight with you here. DeFi is not without risks, and some of them are significant.

The code that runs these smart contracts is written by humans, and humans make mistakes. There have been numerous cases where bugs in the code have been exploited, leading to millions of pounds being stolen. In 2021, a DeFi protocol called Poly Network was hacked for over $600 million (the hacker eventually returned it, oddly enough, but that’s not typical).

Unlike traditional banking, there’s no customer service number to call if something goes wrong. There’s no deposit insurance. If you make a mistake and send your cryptocurrency to the wrong address, it’s gone. Forever. There’s no undo button.

The platforms themselves can be risky. Some are run by anonymous teams. Some are outright scams, designed to take your money from day one. The term “rug pull” has entered the DeFi vocabulary, it’s when developers abandon a project and run off with everyone’s money.

There’s also the risk of the technology itself. If you lose access to your wallet (forget your password, lose your recovery phrase), your money is gone. No bank manager can help you reset it.

And then there’s the complexity risk. Many DeFi protocols interact with each other in complicated ways. This interconnection means that a problem in one protocol can cascade through the entire system. It’s a bit like how the 2008 crisis spread through traditional finance, except it happens at internet speed.

My advice? If you’re going to explore DeFi, start small. Only invest what you can afford to lose. Use established platforms with good track records. Do your research, and I mean really research, not just read what some enthusiastic teenager posts on Reddit. Be skeptical of anything promising unrealistic returns. And for goodness sake, write down your wallet recovery phrase and keep it somewhere safe.

Wrapping This Up

So, what is DeFi? It’s an attempt to rebuild the financial system using blockchain technology and smart contracts, removing the middlemen and gatekeepers that have controlled finance for centuries. It’s ambitious, it’s risky, and it’s potentially revolutionary.

Decentralized finance offers real benefits: accessibility, transparency, efficiency, and control over your own money. But it also comes with significant risks: technical complexity, security vulnerabilities, and the absence of the safety nets we’re used to in traditional finance.

I think DeFi represents something important. Whether it completely replaces traditional banking or simply forces banks to improve their services, it’s pushing financial innovation forward. It’s giving people options they never had before.

But it’s not for everyone, and it’s certainly not ready for everyone. If you’re curious, learn about it. If you’re cautious, that’s sensible. If you’re skeptical, that’s healthy. The technology is still young, still evolving, still finding its place in the world.

What I do know is this: the conversation about how money works, who controls it, and who benefits from it is one worth having. And DeFi has forced that conversation into the open in a way nothing else has for decades.

Whether you ever use decentralized finance or not, it’s worth understanding. Because it’s part of a broader shift in how we think about trust, intermediaries, and the systems that govern our lives. And that’s something that affects all of us, whether we’re 25 or 75, whether we’re tech-savvy or still figuring out how to use WhatsApp.

The future of finance is being written right now. It’s messy, it’s uncertain, and it’s fascinating. And now you know enough to at least follow along with the story.

Walter

Leave a Reply